17 March 2023

Corporation Tax Rates 2023/24

Very little with regard to taxation to comment on generally following the Budget. The main surprise would be abolishing the pension lifetime allowance and increasing to £60,000 per annum per individual a company contribution to an individual's pension scheme!

The increase in the rate of Corporation Tax to 25% has been widely communicated.

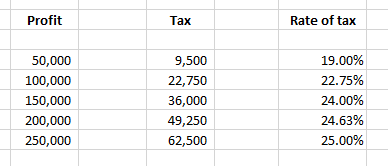

However A) this rate only applies to taxable profits in excess of £250,000. Limited company profits below £50,000 continue to be taxed at 19% with an ever increasing rate between those two bands. See the Table below.

However B) where there are associated companies the lower and upper bands are divided between them.

However C) a company which only receives rents from a connected person is a Close Investment Holding Company (CIC) and the 25% rate of tax applies to all profit.

i) If your profits are seasonal (this year) we will consider if advantageous (or not) to change your accounting date to/from 31st March. We will consider this when preparing the next year's Accounts.

ii) An associated company is by and large one which is under common control with a connected person. This can include family members (or not depending on interdependence between the companies). These rules are quite detailed and this comment is intended to be indicative only.

iii) Dormant and non-trading companies do not count for this purpose

iv) NB if an associated company exists for part of a year (one day minimum) the rate bands are diluted for the whole year. Therefore if you trade through more than one company consider whether these can be merged before 31st March

v) The point above only applies if the companies' profits are uneven. If earnings can legitimately be quite level multiple companies will be quite neutral tax wise (i.e. not detrimental)

vi) It is not uncommon for a business to hold its trading property in a separate group company. It may be appropriate for such companies to have other activities (in some cases and if commercially possible).

vii) One impact of the increasing tax rate for companies is to potentially reduce the benefit of dividends over salaries. In all situations I have modelled so far dividends remain most beneficial but the gap narrows at higher profit levels.

We appreciate these observations will lead to enquiries with regard to your specific situation and request you email your usual contact in this office with any urgent questions.